April 1 NEWS – Federal Aid Package Updates

Today, the Government of Canada announced further details about the Canada Emergency Response Benefit (CERB) application process.

A Good breakdown of Info: https://www.canada.ca/en/revenue-agency/services/benefits/apply-for-cerb-with-cra.html

The government also announced that Canadians can register for the Canada Emergency Response Benefit online as of April 6 at: www.canada.ca/coronavirus-cerb. In order to help prevent overload of the system, the government is asking Canadians to apply for the benefit based on birthdate. This means those born in the first three months of the year (January, February, March) should apply on April 6, those born in the next three months (April, May, June) should apply on April 7th, and so on. While this measure will not impact when Canadians receive the benefits, it will significantly help the system manage the number of claims coming in concurrently.

Key details:

- CERB applications are expected to open online on Monday, April 6.

- Direct deposit payments will be made within three to five days of applying, with cheques taking approximately 10 days.

- Canadians who have already applied for EI do not need to apply again—applications will be automatically enrolled in CERB.

Government announces details of the Canada Emergency Wage Subsidy=CEWS

Key details:

- The program would be in place for a 12-week period, from March 15 to June 6, 2020.

- Eligible employers would be able to access the Canada Emergency Wage Subsidy by applying through a CRA online portal. Employers would have to reapply each month.

- Government will work with non-profit organizations and registered charities to ensure the definition of revenue is appropriate to their circumstances.

- The government expects employers will receive the wage subsidy six weeks after applying.

- At this time, we can report that the CEWS will subsidize 75% on the first $58,700 of salaries for qualifying businesses from March to May. To qualify, businesses will have to show a 30% decline in revenues compared to the previous year in 2019 on a monthly basis. In other words, applicants will need to apply for March, April and May separately.

- The CEWS will be applicable to businesses, including non-profits and charities. This includes cafés, restaurants and bars.

- Businesses will be able to apply via an online portal on the Canada Revenue Agency’s website in as little as 3 weeks’ time.

Expanded child care for Essential Workers

In addition to the previously eligible front-line health-care workers, critical infrastructure workers and first responders, child care is now available to anyone who works in the critical areas outlined as essential by government. A full list of those essential service positions can be found here.

A few tips to anyone before you apply for the Federal Aid Package:

- Set up an account so once you apply your application is processed faster.

- Set up for Direct Deposit. Funds will come to you in 3-5 days by direct deposit as compared to 10 days if they need to send you a cheque.

You can apply for the CERB or Wage subsidy of 75% – but not both. Its one or the other.

Forms are to be available April 6 to apply. Click here…

Weekly Travel Alberta Update to Go East of Edmonton Region

Travel AB is reaching out to us every week to update and understand the most pressing needs.

Travel AB has stopped all paid marketing campaigns to focus on the current Government messaging.

A New Campaign is launched this week on many media channels – Stay Home and Stay Healthy.

We do not have any more info on the following but are very interested to learn what will be announced:

– New Webinars being announced shortly to assist and support Industry partners.

– To Be Announced: Repurposing of Co-op funding to help businesses.

IDEAS for Drive-through or Pickup Lanes to help your Local Businesses

Towns across North America are closing off two to three parallel parking spaces to create an impromptu drive-through and pickup lane for to-go orders at local restaurants. Numerous restaurants are using these “lanes” and appreciate the help as they struggle to remain viable. This idea could also work for local retailers.

WEBINARS to help your businesses: As recommended by Alberta Chambers of Commerce.

- Free CPA webinar: COVID-19 tax updates CPA Canada is offering a free webinar on COVID-19 tax updates on Friday, April 3 at 10:30 MT. Register online.Free Smith School of Business webinar: Coronavirus: What every entrepreneur needs to know

Join Smith Business Insight and Queen’s Executive Education on April 2 at 11 a.m. MT for a free 60-minute webinar offering entrepreneurs a unique perspective on the current situation, and advice on how to overcome the obstacles and preserve your business. Register online.

BUSINESS CONTINUITY PLANNING

Here are some links to resources and samples that could help businesses with managing through this rough period. Think on how to scale or relate to your community even if these resources are from other areas. Any ideas for planning can help you and see what is relevant to your business.

- Sample Issues Management and Communication Plan (to be used as a guide)

- Issues Management Checklist

- Canadian Chamber of Commerce – Pandemic preparedness for business

- Calgary Emergency Management Agency – Business continuity reference guide

- Calgary Emergency Management Agency – Business continuity template

Social Media Tips

Facebook – Small Business Grants Program Facebook has heard from small businesses that a little financial support can go a long way, so they are offering $100M in cash grants and ad credits to help during this challenging time. https://www.facebook.com/business/boost/resource

TAG us @goeastofedmonton, Contact us so we can Help you

Send us an email, or TAG us on Facebook @goeastofedmonton, on Instagram #goeastofedmonton.

Let us know if you made changes and any other unique activities you are doing to get through this tough period.

What we are doing now – Go East of Edmonton…

- Shifting the immediate focus to content and activities with reference to social distancing guidelines or advice.

- Finding appropriate ways to maintain brand and region awareness and engagement.

- Preparing content and campaigns for an inevitable recovery effort.

We are planning for Recovery. We have draft plans and ideas at this time but waiting for more information to be released from Travel Alberta on assistance we may receive or be able to apply for.

We will be contacting Communities and Businesses in the near future to discuss options and your ideas to work together to recover and resume tourism for the region.

To learn more contact:

Kevin D. Kisilevich

GO EAST of Edmonton Regional Tourism

Kevin.goeast@gmail.com

780-632-6191

*******************************************************************

There has been so much information passed around so quickly it becomes quite overwhelming. Much of what has been communicated has not been completely developed yet but this is a highlight of some of what we know so far and what we might want to focus on in the moment.

Update March 27, 2020:

OTTAWA — Prime Minister Justin Trudeau has announced a major increase to the wage subsidy for small- and medium-sized businesses, boosting it to 75 per cent, up from the 10 per cent previously promised. This decision, to help “qualifying businesses” keep employees on staff, is being back-dated to March 15, with more information coming over the weekend.

Trudeau also said the government will be offering a new Canada Emergency Business Account to provide loans of up to $40,000 to small and medium-sized businesses that will be interest-free for one year.

If certain conditions are met, the first $10,000 will be forgiven. We don’t have details but should know more soon.

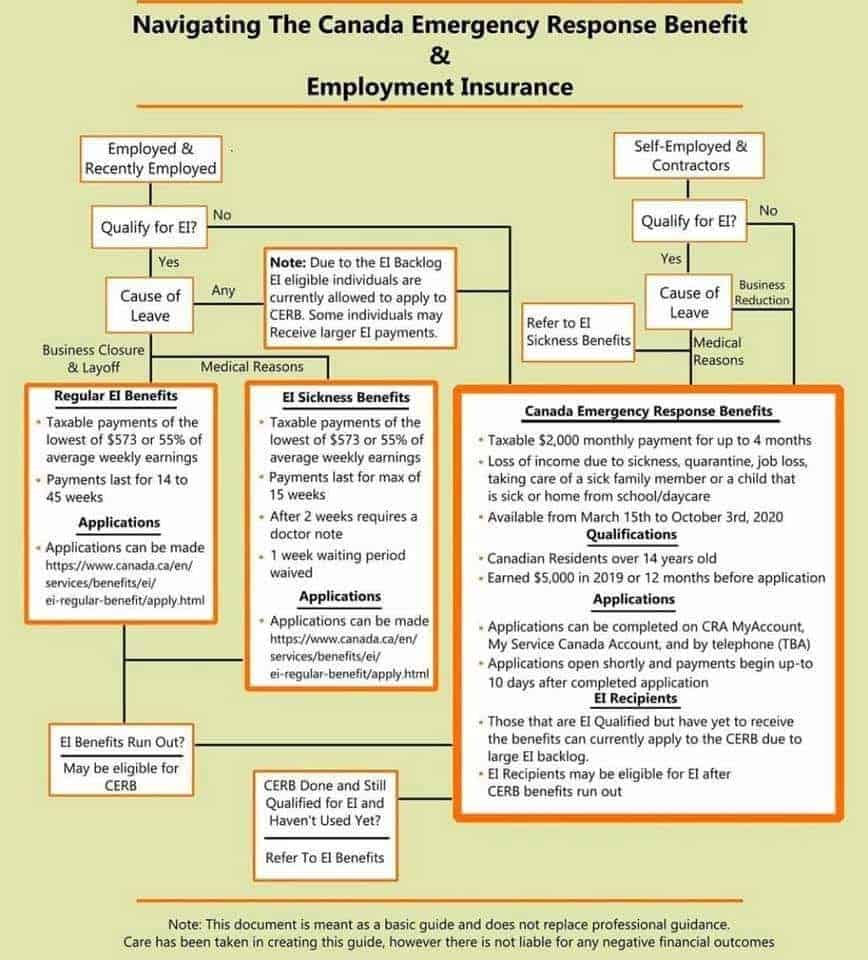

March 25 Update: More Federal Resources – CERB up to $2000 per month.

- The government is merging two previously announced employment insurance benefits for Canadians who are out of or off of work due to COVID-19.

- The new benefit combines the Emergency Care Benefit and Emergency Support Benefit into the ‘Canada Emergency Response Benefit (CERB)’, which will provide $2,000 a month for four months to people who are off of work without an income as a result of this virus. This includes those who have lost their job, contractors, self-employed, those who are sick, in quarantine or taking care of children or seniors. All employees of a business, including the owner, are eligible.

- This will aim to simplify the process – online portal applications will be available soon, and Canadians will be able to receive the benefit within 10 days of applying. The government is hoping to have this initiative in place by April 6th.

- https://www.canada.ca/en/department-finance/news/2020/03/introduces-canada-emergency-response-benefit-to-help-workers-and-businesses.html

March 24 Update:

Government of Alberta:

- One-time payment of $1,146 until federal emergency payments begin in April. An online application should be available this week.

- Utility Payment Deferral Plan

- Student Loan Repayment Deferral Plan

- Deferrals on loans, lines of credit, and mortgages for up to 6 months

More information is available at www.alberta.ca. https://www.alberta.ca/emergency-isolation-support.aspx

There has been so much information passed around so quickly it becomes quite overwhelming. Much of what has been communicated has not been completely developed yet but this is a highlight of some of what we know so far and what we might want to focus on in the moment.

Government of Canada resources: For the latest updates: www.canada.ca

- Information for businesses: www.canada.ca/en/department-finance/economic-response-plan.html#business

DIRECT DEPOSIT

If you are not set up for this (or the business isn’t), please do so. It is the fastest way for the government to get funds to you

https://www.canada.ca/en/revenue-agency/services/about-canada-revenue-agency-cra/direct-deposit.html

PROGRAMS TO HELP FUND LABOUR

10% Wage Subsidy- note this has been changed to 75% and the details are just coming out on that.

There is a 10% wage subsidy that can be applied on wages incurred since March 18, 2020 (currently says it ends June 20 but I think that is yet to be seen). I have attached the link for the FQA’s below but here are the highlights as I see them:

- It’s a manual calculation and there is no way to report it to CRA this time. This will come but still start reducing your payments immediately.

- You are maxed at $1375 per employee and $25,000 for each business number you have

- There is no max per paycheque – so there is potential for you to hit this max in our first remittance

- You get the subsidy by reducing the “tax” component of your source deductions. You can not reduce the CPP and EI amounts

- This can be carried forward, so if tax amounts are less than 10% of your salaries for the period, reduce future payments.

Work-sharing Program

This program allows your team to partially be paid by EI benefits while still working for you at a reduced rate. I would encourage you to sign up for this asap, if there is any chance that you plan to reduce time for your team.

https://www.canada.ca/en/employment-social-development/services/work-sharing.html

There are some questions asked by CRA in this application. Please consider their motivation and think big picture and long term when answering these. Ie. If you don’t get approved, will this lead to additional lay-offs, less revenue, more financial distress?

Employee supports

- If you do end up laying off staff, I would recommend you reach out to an HR lawyer or a labour rep first. There is potential for the rules around “notice” as well as time frame for lay-off to change (I have heard this from AB labour but no announcements yet) and you want to make sure you are in compliance on the day the lay-off occurs

- Once let go, they can apply through the online access however they should also call the number to get the 1stweek wait removed.

- Benefits for your team may still be available until to the end of the month they were laid off in. Check with your benefit provider to confirm.

- For people that have been sick but are still retained, they may be eligible for short term disability depending on factors such as timeline – again reach out to your benefit provider.

PERSONAL SUPPORTS (FOR BUSINESS OWNERS)

As a shareholder, you may not qualify for EI (unless you paid in, you are likely not included in these supports). This may also affect your family members if they are paid from the Company. The government has announced two types of supports coming for people that do not qualify for EI.

- One is related to an immediate quarantine or if you need to stay home due child care or sick family – can apply in April 2020

- You can also apply to alberta.ca starting later this week to bridge the time between federal pmts.

- The other one (which may be an extension of the one above), is very general and very little detail has been released. I do think you will qualify in some form for this however all we can do is stay tuned at this time. (Other countries have matched EI benefits for similar circumstances)

- I would encourage getting any mortgage payments deferred if possible. Interest will not stop accruing in most cases but it is a fast way to free up cashflow

- Like your business you can also defer utility payments personally for 90 days – you need to call in and get set up

CASHFLOW AND PLANNING

I encourage you to generate a plan relating to how you will go forward. Use this document as a guide https://www.mnp.ca/en/posts/business-recovery-defining-your-new-normal, and I would suggest prioritizing which payments need to occur and which ones can be put off.

- Get all loan payments deferred that you can (or that makes sense to you). We have been told that this is a case by case situation and to reach out to your bank rep. for help

- Utility payments can be deferred for 90 days – you need to call and get on the list

- Some tax payments can be deferred but NOT all, see below

- This is a good checklist to think through what else may need to be done asap. https://www.calgarychamber.com/wp-content/uploads/2020/03/Maintaining-business-during-infectious-disease-outbreak-Jan-2020.pdf

- This one is a bit more comprehensive but still really good https://open.alberta.ca/dataset/b7706bea-fa08-486b-b0c6-b967587232b5/resource/eb567854-1ab2-411d-bb59-976938c71b46/download/pandemic-business-checklist.pdf

- If you do not have video conferencing ability and need it, here is a reference for free apps https://www.howtogeek.com/661906/the-6-best-free-video-conferencing-apps/

TAX FILINGS AND PAYMENTS

So far, the only filing requirement that has been deferred is the personal filing to June 1. While some taxes can be deferred all other filing requirements are still required. Note that not filing can still generate penalties.

- Corporate tax amounts that became due after March 18, can be deferred to August 31

- GST and Payroll amounts are still required to be filed and paid on time to avoid interest and penalties.

- Personal taxes are not due until Sep 1

- Workshare program:

For more info check out the Work-Sharing program website or call the Employer Contact Centre at 1-800-367-5693. www.canada.ca/en/employment-social-development/services/work-sharing.html

- Employment Insurance Program:

The Government of Canada offers benefits for individuals who may qualify if they have lost their job. https://www.canada.ca/en/services/benefits/ei.html

-

- For employers: https://www.canada.ca/en/employment-social-development/programs/ei/ei-list/ei-employers.html

- COVID EI claims can be made at: 1-833-381- 2725

Government of Alberta resources: For the latest updates: https://www.alberta.ca

- Information for Employers: https://www.alberta.ca/covid-19-support-for-employers.aspx

- Employment Standards, information on employment rules for layoffs and terminations: https://www.alberta.ca/temporary-layoffs.aspx

- Information for Albertans: https://www.alberta.ca/coronavirus-info-for-albertans.aspx

- Supports for Albertans: https://www.alberta.ca/covid-19-supports-for-albertans.aspx

- Income support policy and contact info: https://www.alberta.ca/income-support.aspx

Additional Links:

- Canadian Chamber of Commerce: http://www.chamber.ca/

- Flexibility regarding filing Taxes: https://www.canada.ca/en/department-finance/news/2020/03/canadas-covid-19-economic-response-plan-support-for-canadians-and-businesses.html#Flexibility_for_Tax-filers

- The Conference Board of Canada – COVID 19 Impacts: https://www.conferenceboard.ca/insights/covid-19

- Alberta Gaming and Liquor Corporation information for businesses: www.aglc.ca/covid-19

- Individual communities’ Chamber of Commerce are updating their websites regularly with very good information

—————————————————————————————————

Other Resources/Information and Webinars sessions of interest:

- Community Futures Lakeland is hosting a webinar to support employers to sort through options and supports available for small businesseswho have employees and are impacted by the COVID-19. Get more information here https://www.facebook.com/events/774034896454496/

- The Calgary Chamber has a variety of webinars and information sessionsavailable for business, check them out at https://www.calgarychamber.com/webinar-series/

- VIDEO: Business Development Bank of Canada, “How to cope with the impacts of COVID-19 on your business”: https://www.bdc.ca/en/articles-tools/entrepreneur-toolkit/webinars/pages/how-cope-impacts-covid-19-on-your-business.aspx

- WEBINAR (TUES MAR 31): CPHR Alberta, Free Webinar Series on Navigating the COVID-19 Pandemic (Webinar Series): https://www.cphrab.ca/cphr-alberta-webinar-series-hr-pandemic-essentials

- INFO/ADVICE: MNP, “Workforce & Employment Issues” section: Defining your New Normal

___________________________________________________

Watch out for fake news on Social media. There is a lot of Non-Factual info about Corona Virus being shared every day. Bloggers are taking advantage of the opportunity. We advise to only share info that is from a Govt or trusted medical organization.

—————————————————————————————————-

Any questions contact us. We are getting updates every day from many sources.

Hang in there. Best wishes to all.

From the Go East Team.

*********************************************************************************

Update March 20, 2020:

Go East of Edmonton is working with our Tourism Partners to learn, share and plan for recovery in the future.

As a result of the precautionary measures taken by our Government to prevent the spread of COVID-19, Alberta’s small business owners are beginning to see challenges and are worried about what’s to come. This list provides current information and resources for small business owners and members of all communities to better understand how to navigate these times.

We will continue to update this page with new information and additional resources as they become available.

Resources for Small Business Owners

Links to make sure your business is prepared for upcoming changes:

- Trade Commissioner – Resources for Canadian Businesses | Contains relevant and important information for businesses navigating challenges and uncertainty in the face of the COVID-19 pandemic. https://www.canada.ca/en/services/business/maintaingrowimprovebusiness/resources-for-canadian-businesses.html

- COVID-19: Pandemic Preparedness for Business | Canadian Chamber of Commerce http://www.chamber.ca/resources/pandemic-preparedness/BusinessPrepGuidePanPrep2020

- Employment Insurance (EI) and Sickness Benefits | The one-week waiting period for EI sickness benefits will be waived for new claimants who are quarantined so they can be paid for the first week of their claim. https://www.canada.ca/en/employment-social-development/corporate/notices/coronavirus.html

- COVID-19 and Business Insurance: How Coverage is Triggered | Insurance Bureau of Canada http://www.ibc.ca/ab/business/COVID-19/

- Coronavirus and Small Business: Keeping You and Your Employees Safe | Canadian Federation of Independent Business (CFIB) https://www.cfib-fcei.ca/en/tools-resources/covid-19-coronavirus-business

- COVID-19: Tips for Small Businesses | Helpful tips as you navigate these changes and work to continue to manage your business and serve your customers. https://businesslink.ca/blog/covid-19-tips-for-small-businesses/

- Alberta Employment Standards Rules | Laws for minimum wage, overtime, holidays, job-protected leaves, vacations, hours of work, earnings, youth workers and termination. https://www.alberta.ca/alberta-employment-standards-rules.aspx

- COVID-19 Preparedness | Edmonton Chamber of Commerce https://www.edmontonchamber.com/covid-19-preparedness/

- Emergency Preparedness | Calgary Chamber of Commerce https://www.calgarychamber.com/resources/emergency-preparedness/

- Free Credit Counselling, Budgeting Help & Debt Consolidation Options | Credit Counselling Society https://www.nomoredebts.org/

- Facebook Small Business Grants Program | Facebook https://www.facebook.com/business/grants

- Alberta Small Business Resources – https://www.alberta.ca/small-business-resources.aspx

Financial Relief

The Government of Canada detailed their plan to support Canadians and businesses financially as we work through these times together. You can find more information on Canada’s COVID-19 Economic Response Plan here: https://www.canada.ca/en/department-finance/news/2020/03/canadas-covid-19-economic-response-plan-support-for-canadians-and-businesses.html

News & Media Releases

Keep up to date on the latest information on the response to COVID-19.

- Canada outlines measures to support the economy and the financial sector | Government of Canada https://www.canada.ca/en/department-finance/news/2020/03/canada-outlines-measures-to-support-the-economy-and-the-financial-sector.html

- What does coronavirus mean for your business? | BDC https://www.bdc.ca/en/articles-tools/entrepreneur-toolkit/publications/monthly-economic-letter/pages/2003.aspx?utm_campaign=MEL–Monthly-economic-letter–03-2020–NEWS–EN&utm_medium=email&utm_source=Eloqua

- EDC stands ready to support Canadian exporters impacted by COVID-19 | Export Development Canada https://www.edc.ca/en/campaign/coronavirus-covid-19.html

- Support for entrepreneurs impacted by the coronavirus COVID-19 | BDC https://www.bdc.ca/en/pages/special-support.aspx?special-initiative=covid19&fbclid=IwAR0JB-ymDmAfpBRhOn6tfZaQeaIg8M8g6mb0R8f24TP1IX5gdclgpDorX90

Health Information & Self-Assessment

Find out what symptoms you should be aware of, how to keep yourself and others safe, more information on the virus.

- COVID-19 | Alberta Health Services https://www.albertahealthservices.ca/topics/Page16944.aspx

- COVID-19 | Government of Alberta https://www.alberta.ca/coronavirus-info-for-albertans.aspx

- COVID-19 | Government of Canada https://www.canada.ca/en/public-health/services/diseases/coronavirus-disease-covid-19.html

- COVID-19 Q&A | World Health Organization https://www.who.int/news-room/q-a-detail/q-a-coronaviruses

- Online Self-Assessment https://myhealth.alberta.ca/Journey/COVID-19/Pages/COVID-Self-Assessment.aspx

Mental Health Resources

Taking care of your mental health is as important in everyday life as it is in times of crisis. Check out these resources for more information.

- Crisis Services Canada https://www.crisisservicescanada.ca/en/

- Find Your Canadian Mental Health Association | CMHA https://cmha.ca/find-your-cmha

- Mental health and coping with COVID-19 | CDC https://www.cdc.gov/coronavirus/2019-ncov/about/coping.html

- Talking with children about COVID-19 | CDC https://www.cdc.gov/coronavirus/2019-ncov/community/schools-childcare/talking-with-children.html

- Help in Tough Times |AHS https://www.albertahealthservices.ca/amh/Page16759.aspx

- Taking Care of Your Mental Health in the Face of Uncertainty | American Foundation for Suicide Prevention https://afsp.org/taking-care-of-your-mental-health-in-the-face-of-uncertainty/

The Mental Health Help Line: 1-877-303-2642 | available 24/7 to provide advice and referrals to community supports near you.

Government Updates

Important updates directly from government resources.

- Canada’s COVID-19 Economic Response Plan – https://www.canada.ca/en/department-finance/economic-response-plan.html

- Coronavirus disease (COVID-19) – Employment and Social Development Canada – https://www.canada.ca/en/employment-social-development/corporate/notices/coronavirus.html

- BDC -Support for entrepreneurs impacted by the coronavirus COVID-19 – https://www.bdc.ca/en/pages/special-support.aspx

- EDC – Support Canadian exporters impacted by COVID-19 – https://www.edc.ca/?utm_campaign=EN%20-%20COVID19%20communication%20-%20Partners&utm_medium=email&utm_source=Eloqua&elqTrackId=fa081c4158d549689bc854b696a8f863&elq=db20b95d7c4c4ee9a60336d0a4aac17c&elqaid=18206&elqat=1&elqCampaignId=

************************************************************** The Recording of “Dealing with the Coronavirus: What to do immediately, to help save your tourism industry & downtown businesses”

The Recording of “Dealing with the Coronavirus: What to do immediately, to help save your tourism industry & downtown businesses”

Is now available by Roger Brooks! Click here.

**************************************************************

About Go East Regional Tourism Actions:

About Go East Regional Tourism Actions:

We want everyone to know that we are here working every day to help promote what needs to be done to update the public regarding tourism and events. Now more than ever we want to help support local communities, businesses and non-profit organizations through this. We are currently looking at ways we can increase promotion for our businesses and communities once it is feasible to do so and get back on track.

With over 25,000 followers on social media and over 150,000 visits to our website every year, we can be a positive force to help through this period and help with recovery.

Here are some important items for you to know about us:

- The 2020 Go East of Edmonton Travel Guide has been sent to print PRIOR to the COVID-19 becoming a serious issue in Alberta, therefore there is nothing we can do to change cancelled events in the magazine. We at the very least were able to put in a disclaimer in the events section and we will update the public through our website and social media of any changes. While we would normally celebrate the fact that we think it is the best issue we have ever created, we are quietly planning for its release in April or when its feasible to launch this in the region and around Alberta. Once we are getting through this period of emergency, we feel it will be a very important tool to help promote our businesses, communities, organizations during this difficult time. Tourism is one of the most important factors in Economic recovery. We will be ready when times go back to normal to make a difference and help the region.

Making adjustments as we go along…

- We are going to hold off putting the Online version of the Travel Guide up on the website so that we may be able to update some events and dates. We do plan on creating a separate online Events & Entertainment Guide and we will move forward on this once it’s safe to do so. It will have the updated event dates for 2020. In the meantime, it is very important for event organizers to keep us updated with their event plans. We know that there is a lot of uncertainty, but we believe if we work together, we can get through this. For marketing questions contact Kevin at 780-632-6191 or kevin.goeast@gmail.com

- Go East Digital Marketing Support. Now, more than ever, social media promotion will be vital, along with website promotion. So, it is important for you to know that your dollars invested with Go East of Edmonton will still be put to good use as we will do all we can to promote your business and Community in the coming months.

- Go East Website Events Updating Daily. At the time of the virus escalating, we had over 600 events on our website- which is the #1 source for tourism events in the region. A huge amount of work goes in every year to update and promote these events. In early March we immediately put up disclaimers that events may cancel on our website. They are inserted to be seen every day from early March till the end of April and will be extended if necessary. We are updating cancelled events daily. https://goeastofedmonton.com/festivals-events/events-calendar/

- Weekly Radio Show Updates. We are still on Country 106.ca every week giving updates on what’s happening. Let us know about your community so we can promote the important changes taking place.

- Travel Alberta Updates. Today is the first day we have received emails and phone calls from Travel Alberta. We gave them our feedback and pressed the need for them to support Rural tourism now, during and after this pandemic is over. Travel Alberta will be contacting us again next week for more updates.

You can see their updated info here at these links:

https://industry.travelalberta.com/news-media/industry-news/2020/02/coronavirus

https://industry.travelalberta.com/news-media/industry-news/2020/03/ceo-message-covid-19

ACTIONS you need to do to help us to help you…

- Contact us about Event cancellations or postponements. While we know almost all events will cancel in the next month, if you are rescheduling that event let us know. Email: donna.goeast@gmail.com.

- You can send us changes to events through this form also here at this link: https://goeastofedmonton.com/festivals-events/events-calendar/event-change-request-form/

- TAG Us. Tagging us in your social media posts is extremely important more than ever so we know what is cancelled, closing or changing in your community. Use this Tag for Facebook and Instagram: @goeastofedmonton Contact jolenek.design@gmail.com for help with social media.

- Contact us for questions if you have any. More updates will come as we continue through this. Donna.goeast@gmail.com, kevin.goeast@gmail.com

Sincerely, the Go East of Edmonton Team,

Donna Jenson, Jolene Kisilevich, Kevin Kisilevich, and Board of Directors.

We need to stick together through this period of time.